Personal Finance - Investment

Understanding the client's financial position

Conducting a financial check-up

Goal Planning

Managing risks

What is Personal Finance - Investment

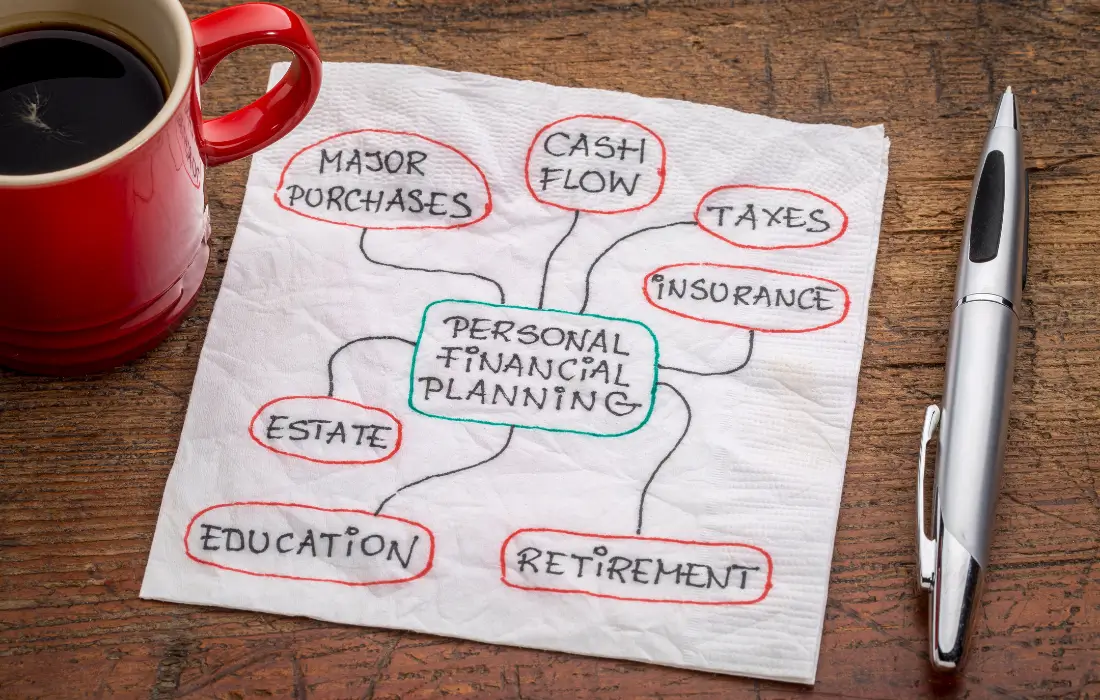

Personal finance encompasses managing your money, saving, investing, banking, budgeting, mortgages, investments, insurance, retirement planning, and tax planning. It includes the entire industry providing financial services to individuals and advising them on financial and investment opportunities.

Mutual fund: A mutual fund is a pool of money managed by a professional fund manager. It collects money from multiple investors with a common investment objective and invests in equities, bonds, money market instruments, and other securities. The income/gains generated are distributed proportionately among the investors after deducting expenses and levies, calculated using a scheme’s Net Asset Value (NAV). In essence, a mutual fund is made up of money pooled in by a large number of investors.

NPS (National Pension Scheme) – First and foremost, the sole reason for investing in the National Pension Scheme is tax saving and thereby securing a place in the retirement portfolio. If you are investing in NPS for any other purpose, you are doing it wrong. There are two types of NPS accounts – Tier I & Tier II.

👉 Tier I Account: This is a lock-in account.

👉 Tier II Account: This account allows you to invest and withdraw at will.

The Tier I Account is the account where all tax deductions are applicable. There are no tax deductions in Tier II. It’s useless to even open a Tier II account.

Cost

of Work

Your asset allocation depends on your risk profile. As age increases allocation into hybrid funds increases and vice & versa.

An emergency fund is essential to help you in case of unexpected events. If you lose your job or face a large expense, you can rely on your emergency fund to support you until things improve. Financial professionals recommend saving enough to cover your expenses for at least three to six months, while some suggest saving for up to a year. Ultimately, the amount you save depends on your ability to set aside funds after taking care of necessary expenses. Having any amount ready for unexpected situations is better than nothing.

This is where a financial professional can help you create a plan that aligns with your budget. Generally, you should consider your current budget, retirement timeline, and goals to determine a savings strategy. You’ll need to factor in retirement expenses and costs such as health insurance and long-term care.

Have questions? Feel free to write us

Call expert

+91 8976444323

Write email

Visit office

603, 6th Floor, Girikunj building, Gopal Bhawan, Ghatkopar (west), Mumbai 400086